Algeria: 2021 finance law announces fiscal measures and imposes additional import restrictions

Event

On 31 December 2020, President Tebboune approved the finance law for 2021. The law introduces several measures to improve public finances, encourage private investments and promote exports. Nevertheless, the approved budget forecasts a further widening of the budget deficit to 13.6%. One of the key elements of the new budget is an expected reduction in imports by 14.4% due to a ‘rationalisation of imports’. At the same time, exports are expected to rise under the assumption of a recovery of oil prices to USD 40 per barrel. Moreover, the finance law introduces new credit term requirements for imports. The recent cabinet reshuffle and call for early elections announced by President Tebboune are not expected to alter the 2021 finance law.

Impact

Algeria’s economic reliance on the hydrocarbon sector has led to large current account deficits since 2014. In an effort to narrow the current account deficits, the authorities seem to focus more on short-term measures to reduce the import bill instead of tackling the longer-term issue of export diversification. For instance, the European Commission has recorded several trade restrictions adopted by the country in the last years such as import bans, import quotas, and higher custom duties for specific products. In 2019 the latest restrictions recorded were difficult conditions to obtain letters of credit from commercial banks for specific imports (e.g. mobile phones), import quotas on cars parts and special custom surcharges on a list of goods varying between 30% and 200% based on the value of the goods. The 2021 finance law introduces more restrictions. For example, it requires 45-day credit terms for all import goods (that will be sold on the market directly, without any further transformation). Only a selected list of goods is excluded from the credit term requirements.

A key weakness for Algeria is that it still relies for 75% of its current account receipts on the hydrocarbon sector. Hence, fluctuations in the oil price drive current account deficits. Ever since the 2014 oil price plunge the country has been running consecutive current account deficits as the current account balance went from a 0.3% of GDP surplus in 2013 to a deficit topping 10% of GDP in 2019 (cf. graph 1). According to the IMF’s WEO October 2020 figures, the current account deficit to GDP ratio is not expected to widen significantly in 2020 despite the sharp drop in oil prices. This is partly explained by a contraction in imports.

The low degree of diversification not only has repercussions for the current account balance, public finances and the hydrocarbon sector – which accounted for more than 40% of public revenues in 2019 – are impacted as well. Consequently, the turbulence in the oil markets following the Covid-19 pandemic and the fiscal effort to support the economy, have once again widened fiscal deficits, erasing previous years’ improvements. In 2020 the fiscal deficit is expected to have reached 11.5% of GDP and under the new financial law, local authorities project it to reach 13.6% of GDP in 2021. As no major fiscal consolidation is announced, it is likely to remain large in the coming years. As a consequence, public debt is expected to reach 90% of GDP by 2024, a significant increase compared to the 8.7% of GDP in 2015.

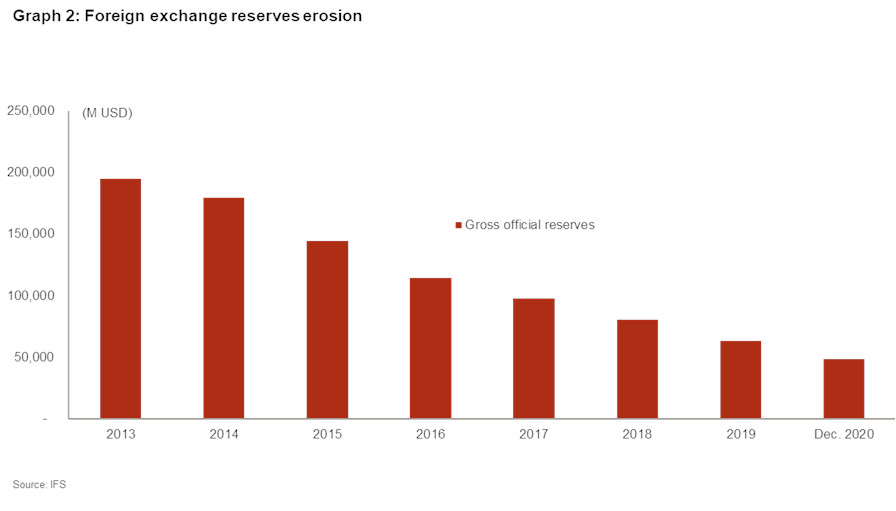

On the positive side, despite the country’s serial twin deficits, the gross external debt levels remain very low. Algerian authorities have been avoiding external borrowing since the debt crisis in the 1990s. In 2020 external debt is estimated at less than 5% of GDP. Despite authorities’ reluctance, if the current external and fiscal imbalances continue, the country may be forced to resort to external borrowing. However, authorities have resorted to Algeria’s extensive foreign exchange reserves to finance the recurring current account deficits. As a result, since 2013 reserves have fallen by around 75% passing from almost USD 200 billion in 2013 to less than USD 50 billion in 2020. Despite this sharp drop, the level of reserves remained adequate for 2020, covering around one year of imports. Nevertheless, the current trend could lead to a depletion of foreign exchange reserves by 2023.

Algeria’s short-term political risk classification remains at 3/7 even though the country was severely impacted by the Covid-19 pandemic amid a sharp drop in hydrocarbon exports. Indeed, despite their gradual erosion, foreign exchange reserves remain ample for the moment. Notwithstanding, a more rapid than expected erosion of the exchange reserves could put pressure on the short-term political risk. The medium- to long-term political risk classification remains at 4/7, but the build-up of fiscal and external imbalances is putting pressure on the classification.

Analyst: Andres Hernandez Cardona - A.HernandezCardona@credendo.com