Steel sector: Global steel prices under pressure amid China’s real estate downturn

China’s ongoing construction crisis drives global steel prices down

The decline in global steel prices is driven by the ongoing real estate crisis in China and, to a lesser extent, by the weak manufacturing activity worldwide. These have resulted in an oversupply of steel, pushing prices down. A situation that echoes the devastating slumps in 2008 and 2015, which led to the consolidation of China’s steel producers.

China’s efforts to revive its construction sector have failed, with new construction starts (a key driver of steel demand) declining by approximately 24% in the first half of 2024, following significant drops in 2022 and 2023. In the forthcoming months, it is unlikely for demand from the property sector to improve because of the significant time lag between land purchase and construction completion. Consequently, many steel mills are expected to cut production further to balance the market and stabilise prices.

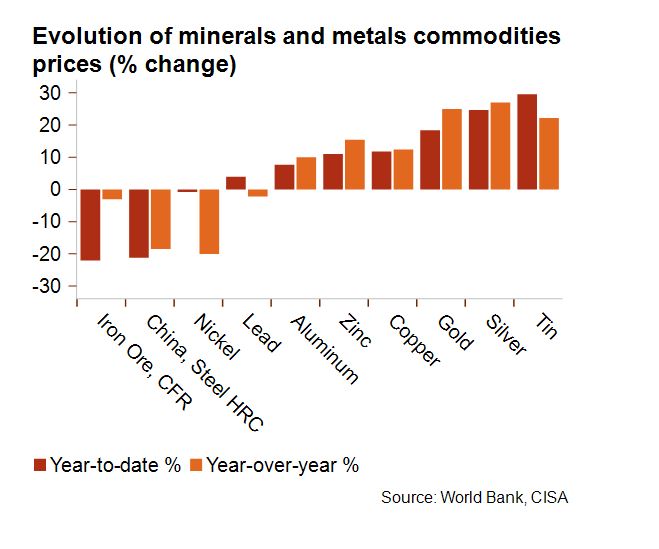

As shown on the graph below, iron ore prices in China have also significantly decreased, as it is the primary ingredient in steel making. Iron ore prices fell further below the USD 100-per-tonne mark and major mining companies are likely to reduce their production to prevent iron ore prices from falling too drastically. Shipments from Australia and Brazil already slowed significantly in July.

Tariffs rise as countries protect industries from influx of cheap Chinese steel

Chinese steelmakers are also turning to foreign markets to offload their production. This resulted in the highest export levels in eight years in the first half of 2024. However, Chinese steelmakers face growing barriers, as other countries impose tariffs to protect their own industries. For example, earlier this year, the USA raised tariffs on certain steel and aluminium products from 0-7.5% to 25%. A move that aims to protect American producers who are struggling to compete while offering higher quality and lower emissions. Initially, the USA claimed that China’s low prices derived from domestic subsidies. However, with the downturn in China’s real estate sector, Chinese steel prices have become even cheaper. In the EU, Chinese steel products are under scrutiny, with a new anti-dumping investigation launched earlier this year. Driven by the competitive disadvantage faced by local producers due to cheaper Chinese imports, some Latin American countries, such as Mexico, Chile and Brazil, have also raised their tariffs on Chinese steel.

The energy transition is an additional challenge

The situation on the steel market is further complicated by the green transition efforts, which add to the long-term competitive threats. Steelmakers are facing significant challenges due to the costly transition from fossil fuel energy to renewable energy. This shift, while necessary for sustainability, imposes heavy financial strain due to high capital expenditure needed for plant conversions. Despite receiving support to bridge the cost gap, long-term structural disadvantages for green steel persist, as importing steel with a high carbon footprint is cheaper than producing green steel.

Diverging trends in other metal prices: aluminium and copper continue to rise, nickel stabilises

However, this recent downward trend in steel and iron ore prices is not observed for other important metals, such as copper or aluminium, whose prices, in contrast, are increasing (see below graph). As for nickel, its price has decreased compared to the same period last year (see year-over-year percentage on the graph below) and has stabilised since the beginning of this year (see year-to-date percentage).

Analyst: Laura Pierssens – l.pierssens@credendo.com