Egypt: Downgrade from category 5/7 to 6/7 for short-term political risk

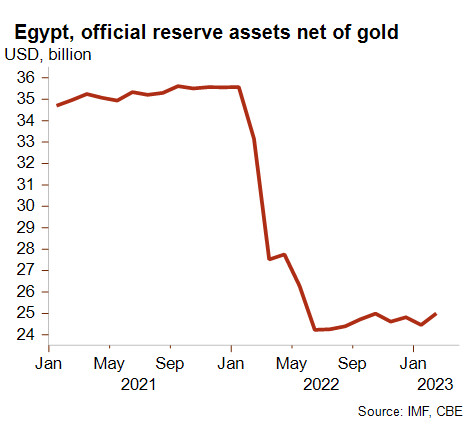

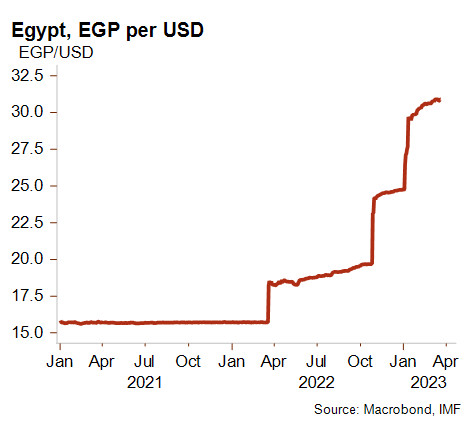

Egypt has been confronted with significant liquidity pressures as a result of ongoing external shocks. The tightening of global financial conditions and the fallouts from the war in Ukraine on commodity prices have created significant pressures on the balance of payments, due to higher import bills and large foreign capital outflows. Moreover, these external pressures have been compounded by important macroeconomic vulnerabilities (e.g. the rigid exchange rate regime), exacerbating liquidity pressures. Last year, Egypt experienced a collapse of its foreign exchange reserves (see graph below) and the country continues to struggle to ease liquidity pressures. Nonetheless, gross foreign exchange reserves have been relatively stable over the last few months amid reported foreign exchange controls.

In this challenging context, Egypt was granted IMF support under an Extended Fund Facility (EFF) arrangement of USD 3 billion in December. Under the arrangement, Egyptian authorities committed to abandon the import restrictions imposed in early 2022 in the form of letters of credit and to implement a structural reform package. Key reforms included in the programme are among others the shift towards a flexible exchange rate and reforms fostering the private sector. Another essential point of the agreement is that the programme is expected to attract further support from international and regional partners, in particular from Gulf Cooperation Council (GCC) countries such as Saudi Arabia.

The external support was expected to gradually ease the liquidity pressures and allow Egypt to clear out import backlogs and cross-border payment delays – a consequence of last year’s import restrictions. In January, authorities declared that import backlogs were already clearing up. Despite this initial optimism, hard currency shortages persist and there are even reports of import backlogs increasing again. A critical obstacle seems to be the perception that Egypt is not implementing key reforms agreed under the IMF agreement fast enough, in particular the sale of public assets and the shift towards a durable flexible exchange rate regime despite three earlier devaluations (see graph above). These reforms are considered paramount to unblock additional financial support. A perceived slow implementation of key reforms could delay foreign investment and hence extend liquidity pressures.

A positive note is that discussions with regional partners and other shareholders about the sale of stakes in public enterprises are ongoing. Nonetheless, given the persisting foreign exchange scarcity despite ongoing IMF support, and the challenging financial and economic environment, Credendo has decided to downgrade Egypt’s short-term political risk rating from category 5/7 to category 6/7.

Analyst: Andres Hernandez Cardona – A.HernandezCardona@credendo.com