Business environment risk: Continuous wave of upgrades

In the framework of its regular review of business environment risk classifications, Credendo has upgraded 35 countries and downgraded 5 others. This second wave of upgrades of the year was again partly fuelled by the decreased recession risks in the eurozone and related small economies.

- Business environment risk

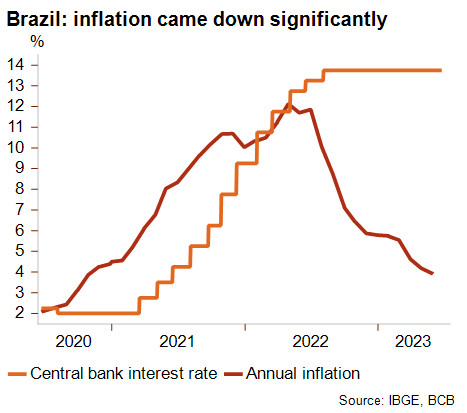

- Brazil: upgrade from category F/G to E/G

Brazil’s inflation clearly came down in the past months and stood at 3.9% end May 2023 (see graph below), which is close to the central bank’s official target of 3.75%. Hence, the central bank might loosen its monetary policy in the coming months after it paused its monetary tightening cycle since August 2022, following the sharp monetary tightening in 2021. This will likely provide some breathing room for companies.

Economic growth has also been surprisingly positive thanks to a record harvest, though real GDP growth remains rather tepid at a forecasted 2% in 2023. Furthermore, the Brazilian real has remained strong, appreciating around 15% vis-à-vis the US dollar year on year. In late May, a highly anticipated new fiscal framework was approved by the lower house. This framework appears credible and is expected to bolster confidence from the financial markets in public debt sustainability, which has in turn decreased the risk of Brazilian real volatility. Moreover, in July, the lower house approved a bill that has been decades in the making to simplify one of world’s most complicated tax regimes. If approved by the senate, it will likely improve the institutional environment and consequently the business environment. In this context, Brazil’s business environment risk has improved and Credendo decided to upgrade its business environment risk rating from F/G to E/G.

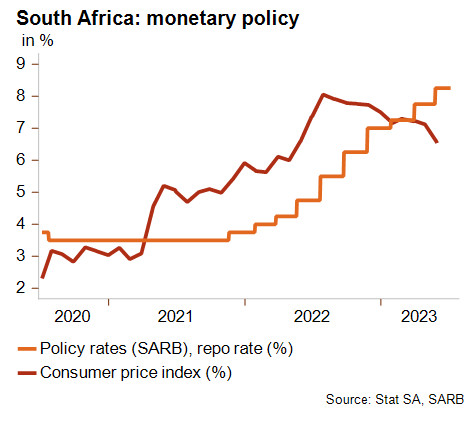

- South Africa: downgrade from category E/G to /F/G

South Africa’s business environment risk classification was downgraded to F/G, the second highest level. The past year has been exceptionally heavy for the country due to devastating power cuts and volatile global commodity prices. The growth prospects for 2023 were revised down to merely 0.3%, weakened by the deep energy crisis on the one hand and consecutive policy hikes by the South African Reserves Bank (SARB) to lower inflation on the other hand (see graph below). Even though inflation has been coming down, it remains higher than 6% (May 2023), leading to ongoing monetary tightening by the SARB. The current account moved into a tight deficit again in 2022, coming from a surplus in 2021. This deficit, together with lower capital and financial inflows, worsened investor sentiment and rising political uncertainty, has been leading to a weakening rand, which lost about 16% against the US dollar since June 2022. In the run-up to the 2024 general elections, the risk of social unrest and political instability will increase. Moreover, the government’s stalling efforts to address the country’s structural weaknesses that have been holding back the country for decades, will further feed the risk for civil unrest.