Argentina: Rough political transition and painful but needed reforms are expected as far-right Milei is elected president

Event

Far-right populist Javier Milei will become Argentina's next president, following a landslide victory in the run-off with Peronist Sergio Massa. Milei’s victory is a political earthquake in Argentina. It has broken the hegemony of the two leading political forces – that was in place since Argentina’s return to democracy in 1983 – namely, the leftist Peronists – which have governed Argentina for 28 of the past 40 years – and their centre-right opposition, the conservative bloc Together for Change (JxC). This victory also confirms a recent trend in Latin America to elect anti-establishment figures. Milei will take office soon, on 10 December.

Impact

Milei is a controversial figure. During his election campaign, he promised an economic shock therapy – with full dollarisation as top priority – and ‘chainsawing’ the public finances, while at the same time insulting, amongst others, Argentina’s biggest trade partners (China and Brazil). Though he does not seem to have taken a promising start, it would not be the first time there is a huge gap between what politicians promise during their campaign and what they are willing and able to do once in office. In this context, it is important to note that in the final weeks of his campaign and after his victory, Milei already considerately moderated his tone, including in his comments towards China and Brazil.

Milei won more votes than any other president in the last 40 years, which will clearly strengthen his negotiation position. Nevertheless, his radical agenda will be difficult to carry out. Milei’s ‘La Libertad Avanza’ coalition only holds 11% of seats in the senate and 15% in the lower house, which will force him to seek a consensus with other parties. Moreover, he does not have any provincial governors – who are very influential in the policymaking process. Milei also lacks executive experience as he has been a member of congress for only two years. The good news for Milei is that former President Macri and former presidential candidate Bullrich from JxC have already lent him their support, but only for ‘reasonable’ reforms. This could ensure a majority in the lower house if the JxC holds, which is not a given as the party is fractioning because of Milei’s radical image. Even then, Milei still needs votes from the Peronists or their allies to pass measures in the senate. As a result, most radical proposals, such as full dollarisation (which seems an impossible mission anyway with the current low level of foreign exchange reserves) or slashing public spending from more than 35% of GDP to 15% of GDP are unlikely to happen.

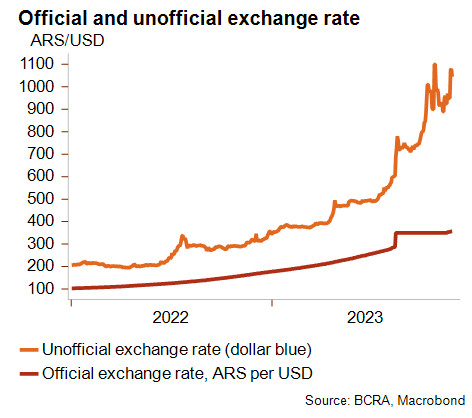

Nevertheless, Argentina’s spiralling economy is in dire need of heavy reforms. Priorities are addressing the currency crisis and tackling a web of multiple exchange rates amid depleting foreign exchange reserves. A series of gradual but large devaluations is likely in the coming months, as the huge gap between the official and parallel market (triple the official exchange rate) is untenable (see graph below). Milei is also in favour of removing all capital and currency controls, but only a rather gradual easing is on the cards due to the high stock of central bank liabilities. Another key task will be to prepare a budget for 2024. Milei will probably enact significant fiscal consolidation, but not at the pace he originally envisioned because with more than half of the general government expenditure going to public salaries and pensions and almost a tenth to subsidies, it is a highly sensitive topic. On a different note, Milei is likely to negotiate with the IMF on fiscal consolidation and Argentina’s IMF programme. Since the last disbursement in August, the current government has seriously deviated from the programme. As a result, it is questionable whether the IMF will continue disbursements, which have proven to be vital to keep the country afloat in the past years.

One of the main downside risks for the upcoming presidential term of Milei is severe unrest. Argentina’s economy is already contracting (at around -2.5% in 2023) while inflation is skyrocketing (143%, yoy in October 2023), but expected devaluations and large fiscal consolidation will push up prices and keep the economy in recession next year. Given the already high level of poverty and unemployment in a highly polarised country, this could fuel severe unrest and result in road blockades, especially as powerful labour unions are backing the Peronist government. Milei said he will crack down potential unrest and he might apply a heavy-handed approach, which could lead to unrest spiralling quickly out of control. Another main downside risk is gridlock if Milei does not moderate his policies or finds enough backing.

The dire state of Argentina’s economy, the high level of poverty and the painful steps that need to be taken in order to fix the economy will likely cut Milei’s presidential honeymoon short. The real difficulty will be to get over the short-term pain, even if that might make the economy healthier in the medium term. Amid looming unrest and the possibility that Milei does not moderate his policies, uncertainty will be the name of the game in the coming months. In this context, Argentina’s medium- to long-term political risk rating remains in category 7/7, while the outlook remains negative for the short-term political risk rating (6/7).

Analyst: Jolyn Debuysscher – J.Debuysscher@credendo.com