Cash transaction insurance

Product benefits

- Payment terms can be split up in milestones during the execution of the contract

- The Belgian exporter is sure to be paid

- No credit, no bank needed

Main characteristics

- Eligible transactions are e.g. construction works, industrial installations, capital goods, services or contract works

- Progressive cash payments to the Belgian exporter following given milestones pro rata deliveries/works

- No credit granted by the exporter or the bank to the buyer

- Risk period starting at order placing and lasting up to several years

- Credendo – Export Credit Agency insures the Belgian exporter against the termination and non-payment of the commercial contract, due to political or commercial reasons

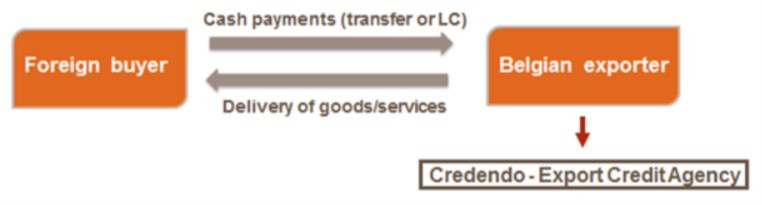

In a Cash transaction insurance, payments are progressive and based on given milestones, done by cash payments (on open account basis or by letter of credit opened by a local bank).

Eligible transactions are especially:

- construction contracts with monthly progress payments, on the basis of certified invoices, progress certificates,…

- industrial installations made up of design, delivery of material, installation, provisional acceptance, final acceptance.

Credendo – Export Credit Agency will indemnify the exporter in case of termination and payment losses due to the foreign buyer, but also as a consequence of political risks.

Why Credendo?

Credendo – Export Credit Agency offers a complete range of products with the same goal: controlling risks related to foreign buyers in foreign countries. The ECA’s products are specifically destined for capital goods, services and contract works from Belgium. Not only Belgian exporters but also banks can make use of the products, which can also result in various financing solutions for the exporter and/or the foreign buyer.

Being the official Export Credit Agency for Belgium, Credendo – Export Credit Agency complies with OECD rules concerning the structure of export credits as well as the regulated premium percentage.