Burundi: Upgrade of short-term political risk amid higher liquidity

Event

The level of foreign exchange reserves has increased significantly thanks to an IMF disbursement and SDR allocation. This enabled the relaxation of import restrictions. In recognition of the improved liquidity situation and economic outlook, Credendo has upgraded Burundi’s short-term political risk rating from 7/7 to 6/7. The category 6/7 reflects both the improvement and the remaining areas of concern: Burundi has a weak external position and still requires measures to address external imbalances and rebuild reserves. An important challenge will be the elimination of the large difference between the official and parallel market exchange rates.

Impact

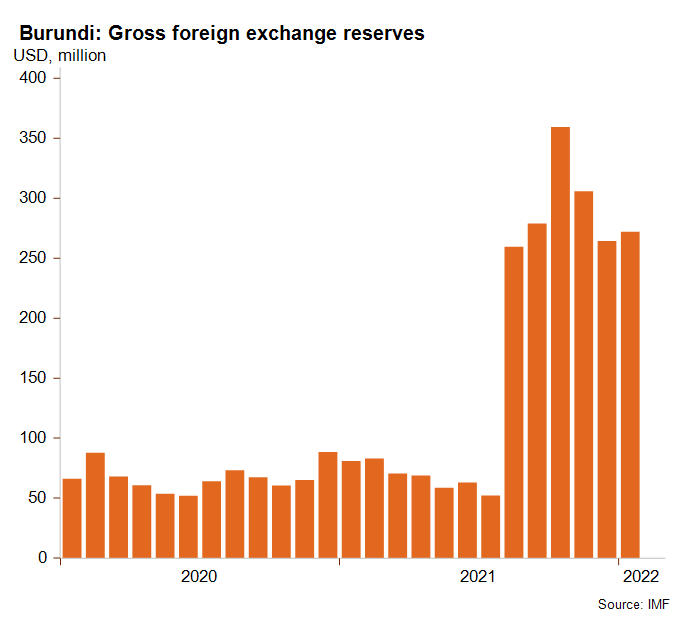

In October 2021, the IMF approved emergency financial assistance to Burundi equivalent to about USD 76.2 million under the Rapid Credit Facility, to help the country deal with the fallout of the Covid-19 pandemic. This disbursement followed an allocation of USD 147.6 million of special drawing rights (SDR) in August of the same year. Both actions have helped the gross foreign exchange reserves increase (see graph) and have allowed Burundi to ease import restrictions. The planned use of the SDR allocation to scale up public investments will also support the economy and mitigate the effects of projected fiscal consolidation.

Another reason for Burundi’s improved liquidity was the recent lifting of foreign sanctions. These sanctions had been imposed after the contentious 2015 elections that featured allegations of irregularities in the voter registration process, arrests of journalists and complaints that violence was being used by the youth wing of the ruling CNDD-FDD party. The greatest controversy, however, had to do with the decision of President Nkurunziza to run for a third term, in violation of the Arusha Agreement of 2000. This decision led to violent protests and even an attempted coup. Violence continued after Nkurunziza won the elections that were boycotted by the opposition. This violence and the associated political repression caused both the United States and the European Union to impose sanctions on Burundi.

The EU froze EUR 432 million in funding. Moreover, some countries, like the US, froze their financial support to Burundi’s budget. Since budgetary support made up an important part of the government’s budget, this has severely limited fiscal space. The combined impact of lower external support and lower foreign direct investments put heavy pressure on the balance of payments, while Burundi’s access to the IMF and the World Bank was also constrained.

President Nkurunziza did not run for a fourth term in 2020, but rather endorsed Évariste Ndayishimiye, who subsequently won the elections. There were concerns that Nkurunziza would continue to exert some influence behind the scenes, but these were rendered moot when the former president died a couple of weeks after the election. The new president has reached out to Western donors, has improved relations with neighbouring Rwanda and has released several journalists and human rights activists. In recognition of these efforts, and because of a significant decrease in violence in the country, the US lifted its sanctions in November 2021 and the EU followed in February 2022.

Burundi’s reengagement with the international community improves the economic outlook of the small economy dominated by the agricultural sector. Both the SDR allocation and the resumption of foreign aid should alleviate foreign exchange shortages, provide fiscal space, and improve economic growth prospects. However, the recovery momentum was disrupted by the conflict in Ukraine. Higher import prices for fuel and fertilisers and lower export prices for tea and coffee are contributing to a deterioration of the terms of trade. In addition, supply chain bottlenecks are amplifying inflation pressures. In this context, the MLT political risk classification remains in 7/7 with a stable outlook. The classification is driven by the very weak economic situation amid notably very large and persistent current account deficits, high reliance on aid and remittances, weak public finances and low flexibility to cope with external shocks.

Analyst: Jonathan Schotte – j.schotte@credendo.com