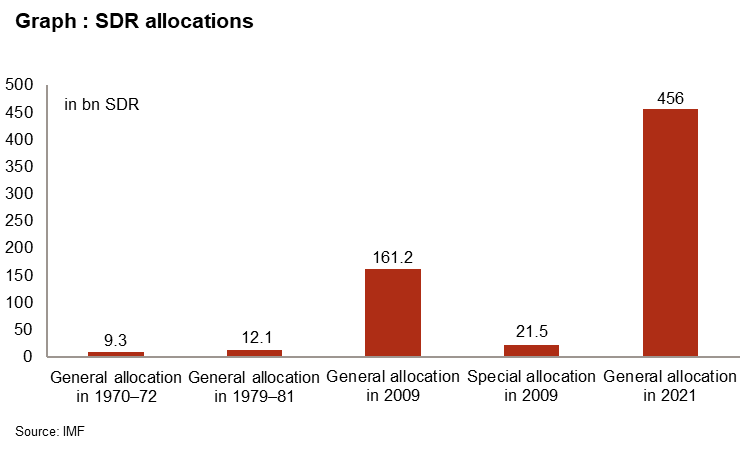

World: Historic USD 650 billion SDR allocation by IMF provides welcome liquidity support for many emerging markets

The Board of Governors of the IMF approved a general allocation of Special Drawing Rights (SDR) – an international reserves asset created by the IMF – equivalent to USD 650 bn (about SDR 456 bn). This is by far the largest SDR allocation in the history of the IMF. The SDR allocation will become effective on 23 August this year. The newly created SDRs will be credited to IMF members in proportion to their existing quotas in the IMF. About 42.2% (around USD 275 bn) will be allocated to emerging markets, of which 3.2% will go to low-income countries. The remainder will be allocated to advanced economies. The IMF is currently discussing with richer countries possible options for voluntarily transferring their SDR allocation to poorer countries. One option being to transfer their SDRs to the IMF’s Poverty Reduction and Growth Trust (PRGT) that provides concessional loans to poorer countries. That concessional support is currently interest free but has to be reimbursed and is attached to conditionality, unlike SDR allocation.

Impact

This historic SDR allocation is going to boost recipient countries’ liquidity, as they will be able to exchange their SDRs for hard currencies with other IMF members. The allocation will therefore also boost gross foreign exchange reserves without creating new external debt. As there is no conditionality attached, IMF members are free to use their allocation as they wish (e.g. to acquire vaccines, pay back external debt, support their economy or stem exchange rate depreciation).

This is a very welcome news for countries that are still struggling with the impact of the Covid-19 crisis. Since the outbreak of the Covid-19 pandemic, the liquidity position of many countries has indeed deteriorated despite the strong support of international financial institutions such as the IMF and the World Bank. In particular, the gross foreign exchange reserves of some countries – a key input of Credendo’s short-term political risk classifications – decreased sharply between end 2019 and March 2021: e.g. Malawi (-51%), Bolivia (-50%), Turkey (-41%), Belarus (-40%), Lebanon (-40%), Sri Lanka (-33% from end 2019 to January 2021), Algeria (-29%), Ethiopia (-25%), Botswana (-22%), Kenya (-15%), Argentina (-15%) and Egypt (-14%).

Higher liquidity buffers would also help countries to withstand a possible tightening of the financial conditions, which could be driven among others by a tightening of the currently very loose monetary policy by a major central bank or higher investor risk aversion. For the moment, global financial conditions remain very favourable. As a result, many countries are still able to issue bonds on the international financial markets at very favourable conditions. However, any tightening of the global financial conditions would inevitably dampen access to the financial market, lead to capital outflows from emerging markets and, hence, increase pressure on liquidity.

Analyst: Pascaline della Faille - P.dellaFaille@credendo.com