United States: Is the role of the US dollar as reserve currency under threat?

EVENT

Since Donald Trump took office, he has enacted a series of import tariffs, notably on 2 April 2025 – the so-called “Liberation Day ”. These tariffs hit many of the US trade partners hard, including historical US allies (EU, UK, Japan) and sectors (steel, aluminium, automotive). However, a few days later, amid a large market sell-off, he backtracked and announced a 90-day pause on reciprocal tariffs (except for China, that dared to retaliate) while maintaining a minimum tariff of 10%. His U-turn is representative of his first months in office, which are marked by policy reversals and unpredictability.

Following Trump’s trade policy announcements, a sharp depreciation of the USD and a market sell-off of US treasury bonds have been witnessed. In this context marked by policy uncertainty in the USA, a key question concerns the role of the USD as reserve currency.

Impact

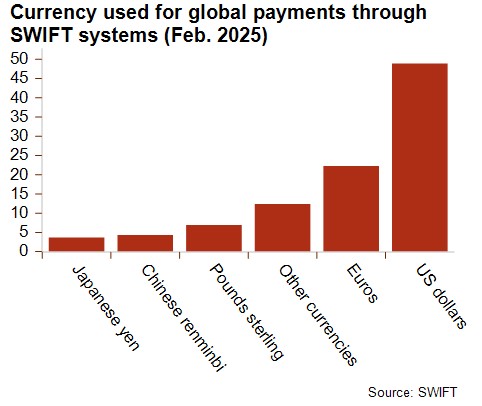

Over more than two decades (see graph above), the US structural current account deficit has been financed by China, Germany and Japan, as well as by oil exporters (when oil prices are sufficiently high) and other countries. This implies that the USA has accumulated large liabilities vis-à-vis the external world, which is a source of vulnerability. However, as long of the USD remains the main reserve currency (see graphs below) , the US current account deficit and large external liabilities are not an issue as the USA is able to attract large capital inflows given the dominant role of the USD. This role is supported by the well-developed and open US financial market.

Though the USD remains the world’s dominant currency, unpredictable and isolationist US policies might weaken its leadership. This is notably true if China decides to sell its US assets, in case of weakening investor confidence about the sustainability of the high US public debt or in case of insufficient USD liquidity. Indeed, the isolationist agenda of the current US administration raises concerns about whether the Fed would be able to issue swap lines in case of need to ensure that foreign central banks have enough USD liquidity, as it has done until now.

The weakening of the US dollar might benefit other currencies such as the euro and the Chinese renminbi (CNY). The latter is increasingly used in global trade, in Chinese cross-border lending and as an official reserve currency, but restrictions on the use of CNY and capital controls remain in place. Therefore, no currency is expected to replace the USD as the dominant currency at this stage as no other country has a sufficiently large economy and open capital market. Hence, we could be heading towards a new system, where multiple currencies would play the role of reserve currencies.

Analyst: Pascaline della Faille - P.dellaFaille@credendo.com