Project Finance Insurance

Product Benefits

- Competitive advantage for the Belgian exporter(s) who can offer a financing solution for large amounts to the SPV which has, by nature, no track record

- The Belgian exporter(s) is/are sure to be paid

- The banks will also be covered in case of non-reimbursement of the credit by the SPV

- Credit structure and pricing follow OECD rules

Main Characteristics

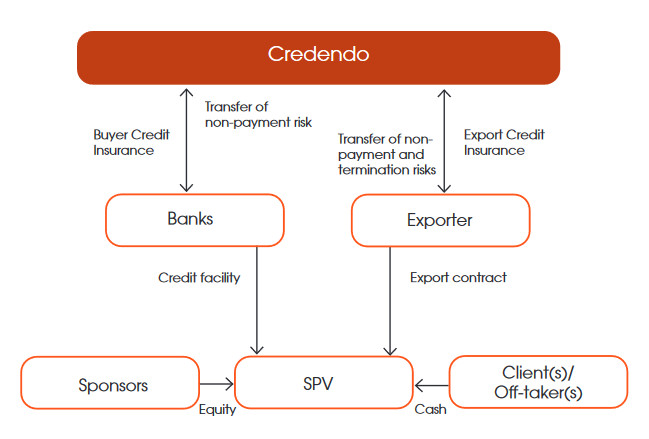

- The sponsors initiate the project and bring equity to the SPV

- The banks grant a credit facility to the SPV, in accordance with OECD rules

- The Belgian exporter(s) can draw on the credit and receive cash payments for the execution of the commercial contract

- The SPV obtains an MLT credit to buy Belgian capital goods, services or contract works and will reimburse the credit to the insured banks at due dates

- Credendo – Export Credit Agency insures the Belgian exporter(s) against the risks of termination and non-payment of the commercial contract and the banks against the non-reimbursement of the credit

Why Credendo?

Credendo – Export Credit Agency offers a complete range of products aiming at controlling risks related to foreign buyers in foreign countries. These products are specifically designed for capital goods, services and contract works transactions. Belgian exporters, but also, in some cases, Belgian importers, can benefit from these products. As the official Belgian export credit agency, Credendo – Export Credit Agency applies the OECD rules concerning the structure of export credits and regulated premium rates.