Short-term political risk: Two countries downgraded, one country upgraded

In the framework of its regular review of short-term (ST) political risk, Credendo has upgraded one country and downgraded two countries.

| Upgrades | From | To |

| Saint Barthelemy | 2 | 1 |

| Downgrades | From | To |

| Bolivia | 5 | 6 |

| Uganda | 4 | 5 |

- Bolivia: downgrade from 5/7 to 6/7

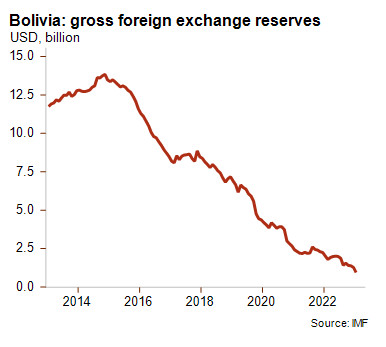

Foreign exchange reserves are quickly decreasing as Bolivia is committed to keep its overvalued peg. They are at a tenth of their peak in 2014 (see graph below) and only at a couple of weeks of imports in January 2023. The foreign exchange reserves are likely to stand much lower today as the Central Bank of Bolivia has stopped publishing data since February. A large devaluation is necessary, but that is a political decision which the government currently refuses to take. However, if the government would decide to leave its peg and implement some macro-economic reforms, the country would see its liquidity situation quickly improve. That being said, the combination of the current administration’s fondness for ideological and interventionist policies, its staunch commitment to the current exchange rate, and the lack of an independent central bank elevate the risk of capital controls or foreign exchange shortages. The very low foreign exchange reserves, in combination with its peg, make the country vulnerable to a confidence and currency crisis as illustrated by the mini run on the boliviano in March. The banking sector is placed under large pressure as well, with a lack of US dollars due to the illiquid position of the central bank and the practice of lending to the central bank with currency swaps. As a result of the deteriorating liquidity, Credendo downgraded the country again this year, this time from category 5/7 to 6/7. The country has a negative outlook and a further downgrade to category 7/7 cannot be excluded in the future, depending on the macroeconomic policies of the government.

- Uganda: downgrade from 4/7 to 5/7

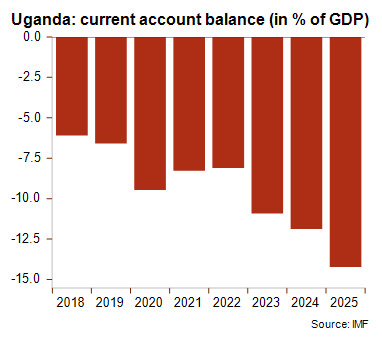

Uganda’s current account balance has been steadily deteriorating and is expected to reach -10.9% of GDP in 2023 (see graph below). This deterioration is also leading to a decrease of the international reserves, both in USD and in months of imports. For 2023, the IMF expects a level of international reserves of 3.2 months of next year’s imports, and a similar level for the following two years.

One of the main reasons for the deterioration in the current account balance are the significant investments in oil infrastructure that are taking place in the country. The main investments are used for the development of the Kingfisher and Tilenga oil fields and the controversial East African Crude Oil Pipeline (EACOP) which will transport crude oil to the Tanzanian port of Tanga. The Kingfisher field is expected to start producing oil in 2025. Once oil production takes off, the country’s current account balance should improve rapidly beyond 2025.