Agriculture: The Black Sea Grain Initiative is approaching a critical moment, with potentially large impacts on global agricultural prices

Uncertainties around the extension of the deal

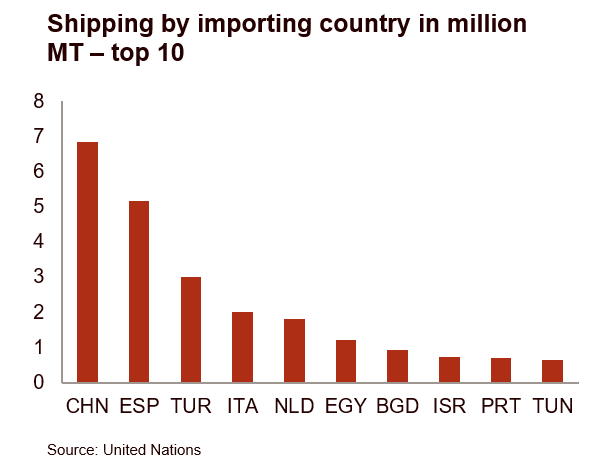

18 May is on the agenda of all observers of international trade. On that date (small delay is possible), we will know if the Black Sea Grain Initiative is extended. Until now, the Black Sea Grain Initiative has been key to moderate global prices of grains (see first graph below). Indeed, according to official figures of the United Nations, 56% of exported commodities via the agreement are destined for developing countries. Shipping by importing region and country under the Black Sea Grain agreement is shown in the graphs below.

However, for the moment, Russia indicated that it would not renew the deal if sanctions against Russia were not lifted beforehand. In the event the agreement is not renewed, the risk for ship owners will be too high and they would stop shipping Ukrainian agricultural products. Consequently, a non-renewal would put a lot of pressure on Ukrainian farmers, who are stuck with high stocks of cereals, while the rest of the world – mainly developing countries – would face an umpteenth food shortage combined with higher grain prices.

Impact on the European Union

Since the invasion of Ukraine by Russia, Ukrainian farmers have diverted part of their grain exports via neighbouring countries by land transport (trains and trucks) and the Danube, despite the Black Sea Grain Initiative, which allows them to continue their exports by sea – but not enough to export at the same pace than the pre-war level. These goods in transit are supposed to be re-exported to other European countries, as well as to Africa and the Middle East, to avoid a shortage of food and to support the Ukrainian economy. To this end, an agreement that allows these foodstuffs to be imported and re-exported without being subject to tariffs and quotas was concluded between the European Union and Ukraine.

However, the shortage of trucks and trains in Central Europe has prevented this transit and Ukrainian cereals have accumulated on the territory of neighbouring countries (Hungary, Poland, Slovakia, Romania), thus exerting pressure on local cereals prices and provoking the ire of farmers who are already facing a bumper domestic harvest. Commercial traders do not want to support the transport of these cereals by rail and road because they deem this too expensive. Spain – a major consumer of Ukrainian cereals – did try to subsidise transport, but found it was cheaper to import cereal from South America. As a result, Poland, Hungary and Slovakia have temporarily banned the transit of Ukrainian cereals through their territory until 30 June 2023, the date on which the aforementioned EU-Ukraine agreement is supposed to terminate, even though trade policy is an exclusive competence of the European Union.

The European Union, yielding to pressure from the countries concerned, is preparing restrictions on imports of Ukrainian cereals into these countries, although this looks more like a regularisation of a de facto situation than a real EU initiative. As a result, Poland has already reversed its transit ban on the condition that the wagons carrying the grain are sealed and escorted to the border of the importing country.

Conclusion

Any disruption to Ukrainian cereal exports – notably driven by an end of the Black Sea Grain Initiative – would have large impact on Ukraine and beyond. Indeed, it is likely to lead to renewed pressure on grain prices, reviving inflation and threaten food security in many emerging countries. To illustrate this, today, an estimated 140 million people in Africa face acute food insecurity, with rising prices putting imported wheat and sunflower oil out of reach of ordinary people.

Analyst: Matthieu Depreter – m.depreter@credendo.com